A restaurant in Arlington, Arlington on August 4, 2020 shows the sign “Hiring Now”. As staff shortages continue, employers are raising wages to hire employees. This further raises the possibility of higher inflation and serious interest rate hikes from the Federal Reserve.

Olivier Toulory via Getty Images / AFP

Hide title

Change the title

Olivier Toulory via Getty Images / AFP

A restaurant in Arlington, Arlington on August 4, 2020 shows the sign “Hiring Now”. As staff shortages continue, employers are raising wages to hire employees. This further raises the possibility of higher inflation and serious interest rate hikes from the Federal Reserve.

Olivier Toulory via Getty Images / AFP

Warning lights are shining for the US economy.

Forecasters now believe the number of forecasters is on the verge of a recession as the Federal Reserve prepares to sharply raise interest rates to combat high inflation for more than 40 years.

This is an unusual outlook at a time when the economy is strong by many measures. Employers have added nearly 6.5 million jobs in the past 12 months and unemployment has fallen to just 3.6%.

But it is a strong economy, especially as employers try to hire more workers as economists try to meet the anxious consumer demand.

As employers struggle to find workers who are in short supply, they auction off their wages, which helps keep inflation above the central bank’s target of more than 2%.

As a result, economist Matthew Lucetti believes the Federal Reserve has no choice but to cut drastically with significantly higher interest rates.

Lucetti predicts that those aggression rate hikes will push the economy into a mild recession late next year.

“It’s surprising to talk about a recession at this point, especially considering the momentum we’ve seen in the labor market,” said Luzzetti, chief economist at Deutsche Bank.

“The end result is that we have very strong growth, but it’s inflationary growth,” he adds.

Other forecasters are also nervous. Economists studied The Wall Street Journal The odds of a recession over the next 12 months were kept at 28%, up from 13% a year earlier.

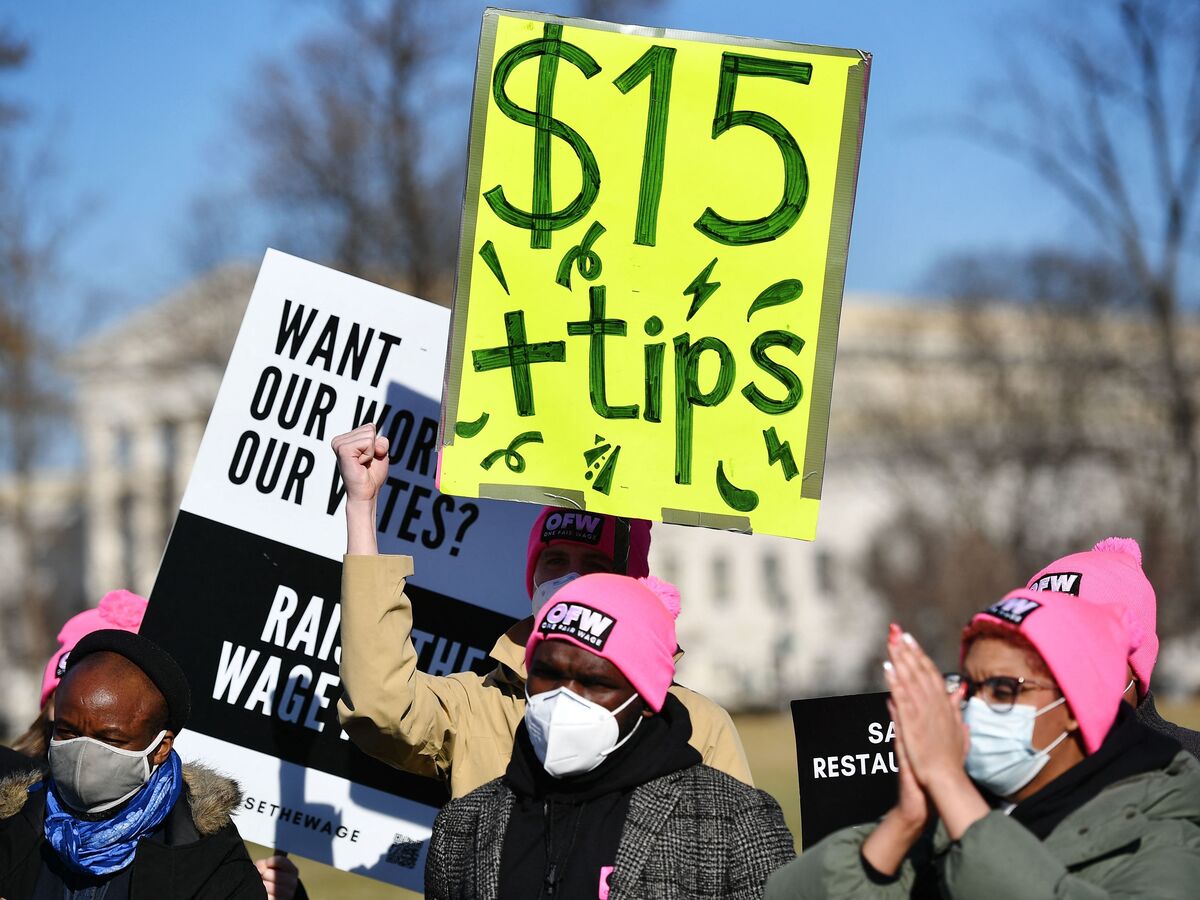

During a rally at the House Triangle of US Capitol in Washington on February 8, an activist held a card demanding a minimum wage of one hour and tips for restaurant staff.

Mandal Nagan / AFP via Getty Images

Hide title

Change the title

Mandal Nagan / AFP via Getty Images

During a rally at the House Triangle of US Capitol in Washington on February 8, an activist held a card demanding a minimum wage of one hour and tips for restaurant staff.

Mandal Nagan / AFP via Getty Images

Inflation is everywhere

For most of last year, the central bank considered inflation to be primarily the result of supply chain scrolls that would act on their own once the epidemic subsided.

On the contrary, inflation has accelerated. Consumer prices rose 8.5% in March from a year earlier The data were released on Tuesday – Sharp increase after December 1981.

Relief on the supply side is taking longer than many analysts expected, and Russia’s invasion of Ukraine has added to the disruption, affecting both food and energy exports.

“We continue to push our expectations of when these supply chain issues will be resolved,” Lucetti says. “This is an area where the recent invasion of Ukraine has exacerbated those price pressures and the supply chain problems we face.”

Tuesday’s inflation report showed little relief from the epidemic recession. The price of used cars – which rose last year when the shortage of semiconductors blocked new car production – fell 3.8% in March.

But thanks to the unsatisfactory demand of consumers for goods and services, the prices of many goods continued to rise.

If inflation is high, workers may demand higher wages – a recipe for the wage-price cycle that contributed to inflation in the 1970s.

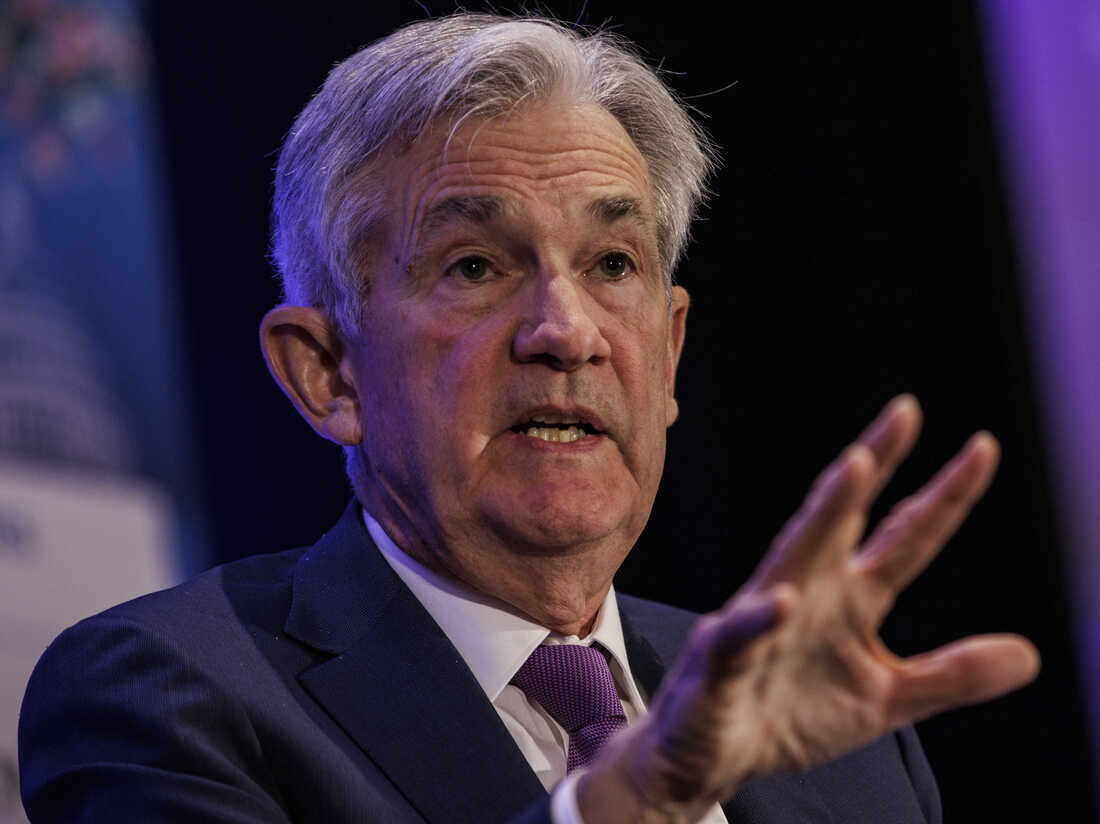

Federal Reserve Chairman Jerome Powell speaks at lunch at the 2022 NABE Economic Policy Conference on March 21 in the Ritz-Carlton, DC, Washington

Samuel Coram / Getty Images

Hide title

Change the title

Samuel Coram / Getty Images

Federal Reserve Chairman Jerome Powell speaks at lunch at the 2022 NABE Economic Policy Conference on March 21 in the Ritz-Carlton, DC, Washington

Samuel Coram / Getty Images

The tricky balance of the central bank

Last month, the central bank began raising interest rates in an effort to reduce consumer demand and bring prices under control. At best, the central bank will cool inflation without sending a chill to the entire economy.

However, the monetary thermostat is not very accurate. Some forecasters worry that the central bank’s chances of getting it right are not good.

“It could happen,” says former Treasury Secretary Larry Summers. “But I don’t think it’s very possible.”

Summers argued For more than a year With large Govt-19 relief payments and rock-bottom interest rates, both Congress and the central bank are paying more into the economy.

Summers argues that it would have been better if the pipes had been turned off sooner. The resulting high inflation will now be less painful.

“The bathtub is overflowing now,” Summers says. “And it’s much easier to prevent a bathtub from overflowing than to withdraw water.”

People on April 12 in North Bethesda, Md. Buy groceries at a giant food supermarket in.

Anna Manimeker / Getty Images

Hide title

Change the title

Anna Manimeker / Getty Images

People on April 12 in North Bethesda, Md. Buy groceries at a giant food supermarket in.

Anna Manimeker / Getty Images

Why should the Fed be called a ‘soft landing’

Not all forecasters share that dark perspective. In Wall Street Journals In a survey, 63% of economists said they believe the central bank can create a “smooth landing” that will keep inflation in check without triggering a recession.

Brian Dees, director of President Biden’s National Economic Council, acknowledges the economic challenge posed by high inflation, but argues that a stronger job market and more money in consumer bank accounts should help.

“The United States is in a better position than any other district in the world to go through this difficult period,” Dees told a funding forum last week. Christian Science Monitor.

Summers says he understands why both the White House and the central bank were interested in keeping the economy warm and raising workers’ wages.

“The increase in demand is deeply good for workers,” he says. “But if they are not sustainable, they will need a subsequent recession, and eventually they will boomerang.”

Summers, a Democrat who has served in the Clinton and Obama administrations, has also issued a warning to the Biden administration and Congress Democrats.

Voter frustration over high inflation has helped fuel Republican victories in the past, he says, from Richard Nixon to Ronald Reagan.

The United States now has a chance to see if that history repeats itself in the midterm elections later this year.

“Friend of animals everywhere. Devoted analyst. Total alcohol scholar. Infuriatingly humble food trailblazer.”